The growing popularity and reach of smart phones and internet along with social media has made each of our lives go “digital” from the first minute of our day until the last! In addition, the Government taking very pro-active steps towards digitalization and smart-towns have increased internet connectivity and wifi in townships. This has enhanced the rate of growth of digitalization in India. The mega-trend is only increasing by the day. From travel to fashion to personal finance, comparing online has become an inner instinct before actually buying. Even before trying a new restaurant or booking a hotel online, we always check reviews, view pictures before trying it out.

Digitalization of India

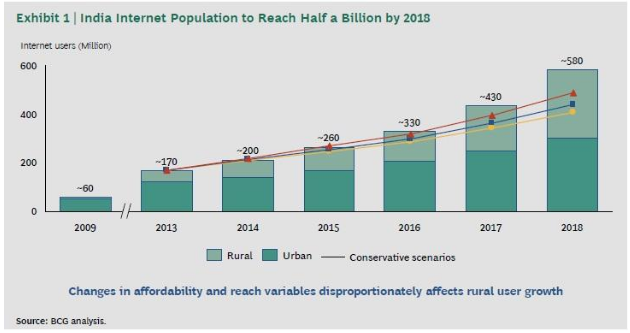

In this rapid growth of digitalization, reach of internet in the semi-urban and rural areas as well as increased awareness is creating a huge role. The rise of smart phones has revolutionized this space and is expected to rise by another 89% in the next 4-5 years as per Boston Consulting Group’s report on India @Digital Bharat. Government is also very pro-active in such matters by providing low cost internet services and free wifi towns. As per the TRAI data, 3G and 4G services are likely to rise by another 50% by 2018 with higher rural penetration.

According to this BCG report, there are 4 key impacts of digitalization:

- Most transactions to be facilitated by the internet like banking, e-Tailing, consumer goods, travel etc. and the trend has already set in and is on the ever rise.

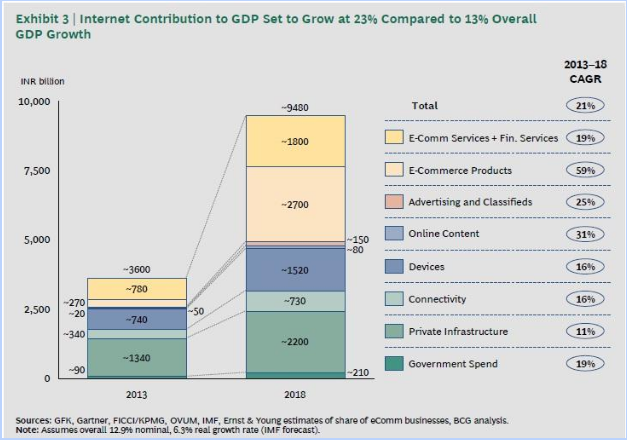

- Direct contribution to the growth of the GDP to about 23%.

- Much larger social benefits.

- Direct benefits to the internet users in terms of time savings, offers, etc.

Internet contribution to Financial Services

An excerpt from the BCG report on Decoding @Digital Insurance:

This clearly states that internet influences eCommerce and Financial Services to a stupendous growth of 19% with 31% contribution by Online Content. Mobile Traffic to grow by 11 times by 2018. With digitalization reducing overall transaction costs, banking, insurance and other financial services providers are super happy as this is a very powerful tool. Social Media has also gained popularity around the world.

Digital Influence in Insurance

Digital India is more than 3 times the digital sales in India, i.e. most people ensure they check the products, reviews and comparisons online but not necessarily purchases them online. Insurance industry is still largely a Compare-Online-Buy-Offline industry with LIC agents ruling the space.

However the digital footprint has been growing phenomenally with pre-sales and post sales services. The digital footprint contributes to 28% of all internet users, with 15% of them actually using any of the following services like pre-purchase, purchase or post-purchase services online with only 6% of them buying the product online.

Pre-purchase consists of searching the products and its information online, reviews, feedback, store locations, price comparisons, discounts and coupons available, etc. This is the largest segment of the digital influence, which larger players in the industry are trying to capitalize. In the western world, Insurance is one of the Top 5 products that are digitally influenced after travel, media, entertainment activities and books.

Google Algorithm shows High Digitalization in Insurance

The Google Analytical Barometer showed large surge in customer searches and queries in the Life and Health Insurance space. For example, 14% of the health insurance buyers were digitally influenced in 2013 with the number more than 8 times in 2016.

A joint study by Google and Boston Consulting Group, BCG reveals that the digitally influenced payments in India is likely to contribute to 15% of the GDP of the country by a whopping $500 billion by 2020!

The search engine analytics of Google Search in 2015 has revealed certain trends like:

- 60% of shopping queries from mobile searches rather than website one.

- 50% of Google search volume in searches and seeks information with 60% of You Tube views!

- Traditional searching has moved to buying personal care and furniture online and a rise in video-on-demand.

- Women users are more engaged than men with 40% contribution by You Tube videos!

- The primary user has information across industries and is not specific to anything in particular.

- Emergence of “How-to” content and videos with customer centricity has risen

- Banking and insurance products becoming simpler with technology!

Thus, the digital influence space has been largely taken over by videos in the era of 2015 with a stronger foothold in 2016.

Videos as a strong foothold in Insurance sales

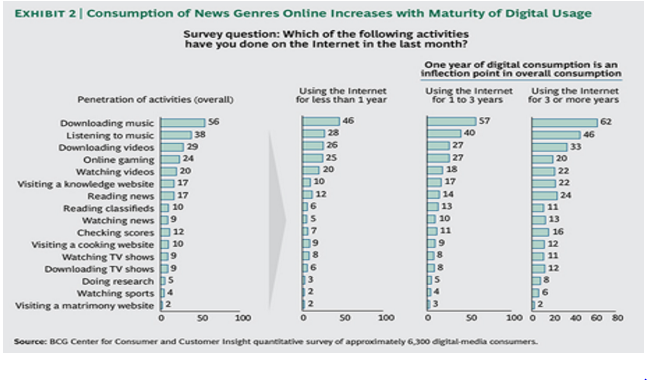

The consumer patterns have evolved over the time and with internet usage maturity.

With maturity in internet usage, the influence of videos have taken a strong rise in the digital media space and the BFSI industry is not far behind. The SEBI regulated investment awareness programmes as well as IRDA regulated content is mostly being released in the form of videos.

Although long form content is not so popular these days as attention span for readers have reduced phenomenally, YouTube seems to have capitalized on it. BFSI industry has started to engage customers in Long Form Creatives on YouTube videos in 2015 and is continuing the trend!

The Insurance Industry started with long form creative with Tata AIA Life, SBI Life, HDFC Life and Birla SunLife taking the lead!

They started with You Tube videos and then took to TV and other screens. The top 6 videos amongst the top 10 YouTube most viewed videos in the Insurance Industry has used long-form creatives! As per the research of market leader ICICI Lombard General Insurance, online has become a significant channel for insurance sales, especially auto insurance in 2015. The persistency of online sales is 35% higher than that of offline sales with lesser cost and intervention. There is also a 30% rise in the demand for online education and the BFSI industry is a recipient of this. You Tube has in fact become the 2nd largest search engine after Google with How to videos trending the chart!

The way ahead

The way the industry moves, there is sea change happening every year and the industry is expected to grow by 8 times by 2018, i.e. in just 2 years! The industry growth is driven by Programmatic, which is expected to be 40% of the revenue share by 2018. Thus, a huge share of this Programmatic Growth is likely to be channelized by Video Marketing as a large portion of video display gets bought programmatically. More than 63% of young people on the internet is glued to online video and 52% of them even watch it in groups with the key motivation is to learn something new or pure entertainment! Even web-series and video content has got a huge traction and is expected to quadruple by 2018! Viewership and watch time on You Tube videos has seen a double digit growth in 2015 and is expected to cross the 20% mark in 2016.

(Source: bestmediainfo.in)

Hence, research states that investing your money to generate online videos would a higher return on investment than any other form of media!